Young professional from the present generation doesn’t seem to put in too much thought into future financial planning and retirement. But, it’s the time that we have on our hands that will eventually put us in a position of comfort by the time we’re closing in on retirement. Working out a plan for retirement isn’t rocket science, it just needs tact and discipline.

Here are a few simple steps to get there:

1. Save early. But a savings account might not be the best idea for high returns. Invest instead.

Saving smaller amounts in your 20s for a longer period of time compounds into a much higher return than bigger amounts later on. But it is investment into viable policies that will give the kind of return you are looking for in the long run. Inflation and lower rates from savings accounts may in fact reduce your money’s value. Start a retirement fund right away rather than later.

2. Invest in liquid funds and debt funds, along with policies with long term benefits.

If you’ve found a good prospect for yourself, a startup, mutual funds, insurance or even penny stocks, find yourself a good advisor – fathers are usually a great help – and invest. Start off by investing small amounts – like ₹5000 per month – in liquid funds, then start depositing amounts with an increment of 10% annually. Keep a close eye on the market and you could get returns from mutual funds as high as 60% for a 3 year tenor.

Some of the sought after insurance policies offer ₹1 Crore cover at ₹17 per day.

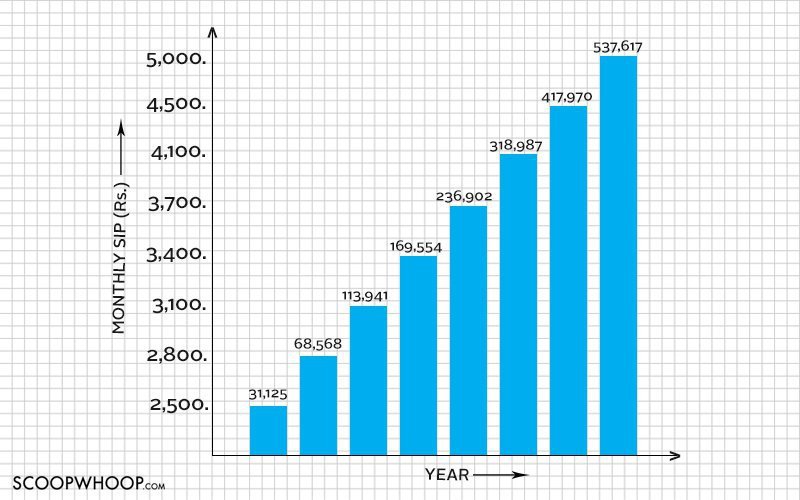

Now, let’s assume that you start with a monthly investment at ₹2500 with smaller increments each year, your returns would look something like this.

Don’t jump into equity funds too quickly.

Equity growth fluctuates with time. Although the returns are higher, wait for at least 2 years before beginning to invest into an equity fund to create a sizeable back up. Also, by this time we assume you would also experience a salary increment.

3. Crunch time if you’ve got credit card debts. Credit card backlogs could quickly rise into lakhs if ignored.

Credit card debts are that soul eating baggage that’ll compound and creep up on you if you don’t keep them in check. Any manner of saving begins with plugging existing holes, and a debt is something you definitely want to steer clear of. Prioritise on taking care of credit card backlogs right away.

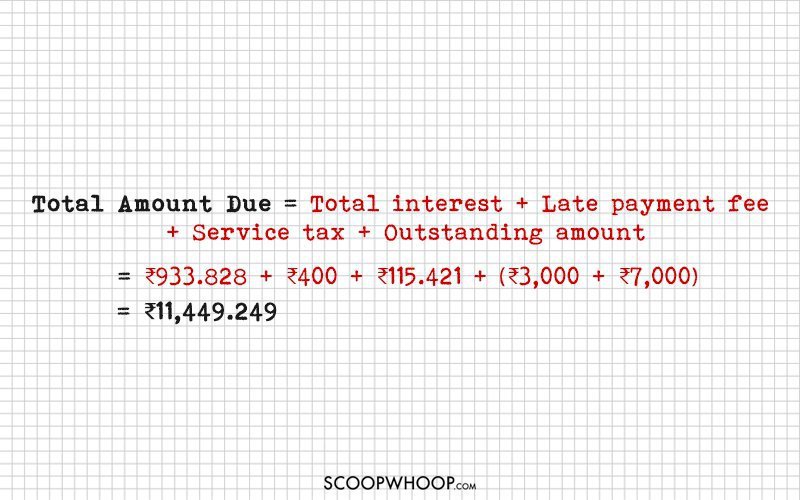

Let’s assume you were late on a credit payment of ₹10,000 in the first month at about 3.6% interest rate monthly, the debt would be calculated something like shown below.

As of March 2015, outstanding amount on credit cards was ₹30,500 crore for a little over 2 crore holders. And a small interest rate like above could quickly compound in a year.

4. Curb the expenses and plan them out systematically.

Now, we get to the tricky bit. Yes, as old and ‘heard of it too many times’ this piece of advice might be, your parents are bang on about it. Have fun and splurge with a sense of responsibility kept it in mind.

An average of at least 15% of your income should be saved, and that’s a conservative number.

5. Stick to the plan, this is meant to be long term with visible returns at the end of decades.

Like any plan, this won’t work if you don’t stick to it. We’re talking about a regimen that needs to last for at least the next 2 decades for you to be able to see any tangible change. Yes, ₹1 crore in 15 years is a possible plan, but it requires discipline. Follow these simple steps to a T and you’re sorted.

Feature Source: savemoneyindia.com