First experiences matter a lot, and some of them are worth adding to your dear diary. The first time you started walking, the first time you said your first word, the first time you made eye contact with your crush, the first time you had a kiss or fell in love, and so on and so forth. And of course, those experiences are equally important in professional lives as well. Remember when you received your first paycheck?

Here I am revisiting the firsts in my career and how I managed finances during my initial professional journey.

Let’s start with my first internship. I interned under a fashion blogger in New Delhi during my college days. It was a two-month period of paid work. Yes. I got paid. I received my first paycheck of ₹2500 at the end of my internship. And it certainly wasn’t worth travelling for hours and spending extra money other than college to get some experience. It wasn’t about the figures then but receiving my first-ever cheque. It brought a smile to my face.

I gifted my mom a saree and my dad a shirt from the internship stipend. I submitted the remaining amount to my bank account. Why? Because I have watched my parents work hard to reach where they are today. I could have easily spent it on myself, but I chose to contribute a portion of it to my parents while also beginning my saving journey.

I received my first job salary at the end of 2017. The company I started my professional journey with is in Noida. I decided to shift to save time and energy. I got a shared room in a rented apartment ‘coz I couldn’t afford the separate flat with a salary of less than ₹20k. And suddenly, my life changed. From paying a monthly rent of ₹6k, managing bills, arranging food and groceries, spending a chunk on my grooming and fitness along with travelling back to my home during the weekend, I was accustomed to handling all my finances by myself. More than half of my salary (₹10k) would go into expenses.

I didn’t invest my money as most people do, because tbh, mutual funds haven’t been my cup of tea. I didn’t plan my expenditures or create a budget. I wish I had known about the 50-30-20 rule. (For the unversed, this rule means putting 50% of your money towards needs, 30% towards wants, and 20% towards savings.) Having zero ideas about balancing the finances back then, I would spend 50 per cent on my ‘needs’ but overdo it on my ‘wants’ like clubbing, hair spas, manicures, etc. which left me with fewer options to save.

However, things changed a bit after I got a promotion and increment. I started to focus more on savings. I chose not to attend parties in clubs, for which I was quite regular. I started to cook more at home than ordering online, with a few exceptions, and that saved me around ₹3000-₹4000. I managed it somehow for three years before the lockdown happened and I decided to stay with my parents again.

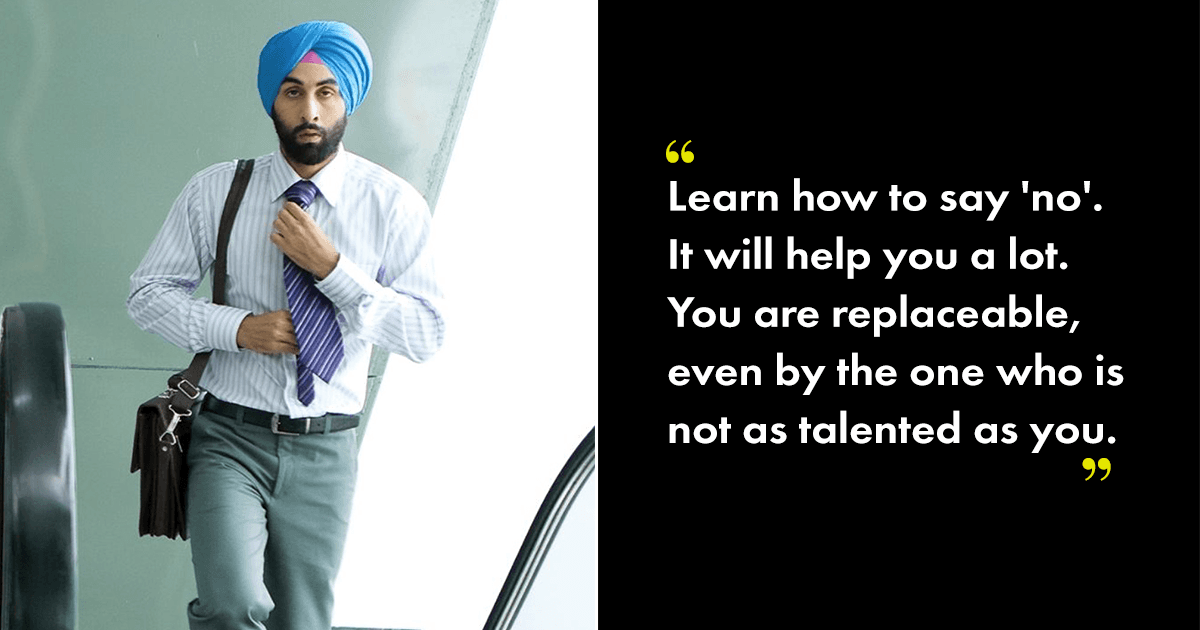

And that was my journey of firsts. Below are the takeaways from my experience:

- With time, I have learnt to balance my earnings without compromising my needs, wants, and savings. For the ones who are starting their journey, try to focus on all these three main factors that can improve your finance handling habits. You can find alternatives for your needs and wants like cooking at home and inviting your friends at home for house parties.

- I have a pile of clothes in my wardrobe that I bought during my first job. I hardly wore some of them to date. I have minimized spending way too much on my outfits which I believe I should have started earlier. Try minimal clothing and you won’t regret it.

- You can always opt to share a room with your flatmate. Not only it will strengthen your bond with them, but it will also help you save some portion of your salary.

The right amount of ingredients can do wonders for your dish. Isn’t it?