Ever been to a restaurant and been totally confused about your bill? You ordered Rs 2000 worth of food and drinks and yet somehow your bill amounts to almost Rs 3000. You may wonder w hat kind of sorcery this might be… Don’t fret! It’s not sorcery, just clever billing on the part of the restaurant.

If you look closer, you will see a number of taxes that have been added to your subtotal which eventually sum up to the grand amount you will be paying. Now, some of these taxes like service tax and value-added tax (VAT) are expected by law, whereas, service charge, which may seem like a tax, is actually just the restaurant charging you a little extra. Lovely realisation, isn’t it?

On July 14, the government clarified that service charges collected by the restaurant and then retained by the restaurant are not imposed by the government. The only taxes imposed by the government are service tax and VAT (which differs state-wise).

All of this gets a little confusing from time to time, but, it’s important to understand in order to make sure you aren’t being cheated. So let’s break it down:

Service Tax

Service tax is the tax levied by the government for services rendered by the restaurant. The tax amount is the same in all states — 14%. In the most recent budget Finance Minister, Arun Jaitely raised the amount of service tax to 14%.

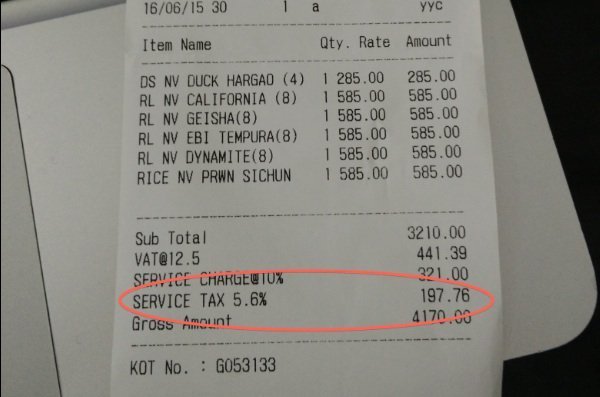

The important thing to note about service tax is that it is only charged on 40% of the total bill. Therefore, if your bill is Rs 1000, the service tax will only be charged on Rs 400 (i.e 40% of 1000). In order to make things easier for themselves, restaurants need to charge service tax on the entire amount, thus reducing the amount to only 5.6% of the bill.

The correct amount of Service Tax you should be charged | Source: ScoopWhoop

It also important to remember that only a restaurant that has central air conditioning or heating in some part of their facility has the right to charge service tax.

Service Charge

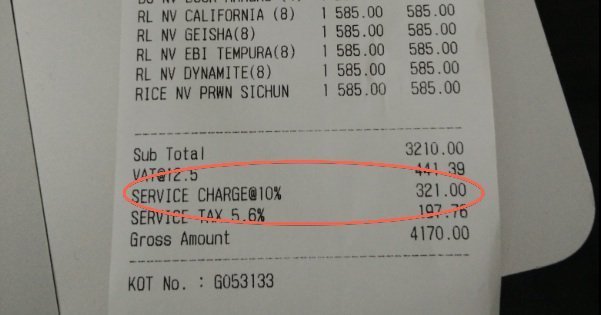

This is charged by the restaurant for the services rendered to you. Since the money goes to the restaurant, the establishments are free to charge what they like, as there are no guidelines provided by the tax authority. The charges can vary from 5% to 20% — it depends upon the restaurant. In some cases the money from service charge is shared among the wait staff as tip, in which case you would not be required to tip the waiter.

The ground rule is that if the menu states a service charge is added, then you have to pay it. But a good method to adopt would be to question if the charge is used as tip mechanism and if it will be shared by everyone in the restaurant.

Service Charge varies from restaurant to restaurant | Source: ScoopWhoop

It is important to note the difference between the two charges. Always keep in mind that service tax is what you pay the government and the right amount you have to pay is 5.6% of the total bill OR 14% on 40% of your total bill.

Don’t let the maths confuse you… that is what they want. If you don’t completely understand how much tax you’re paying, ask the restaurant manager to give you a bill with the breakdown clearly written. Most importantly, make sure not to get swindled by the restaurant.