The Greek debt crisis took a turn for the worse on June 28. The government announced that all banks would be shut down and a limit would be placed on how much can be withdrawn from ATMs in a day. The stock exchange will also reportedly be shut down.

Greece is quickly slipping toward defaulting on its loans and heading towards an exit from the Euro zone.

The trigger for the rapid escalation of the Greek crisis, was the government’s decision to pull its negotiators out of bailout talks on June 26. Prime Minister Alexis Tsipras rejected a draft proposal from the European leaders and the International Monetary Fund (IMF) and said that he would present it as a referendum to the Greek people on July 5.

Tsipras rejected the proposal as he felt he had been presented with a take-it-or-leave-it-offer that is effectively indistinguishable from the policies of the last five years. Accepting this proposal would destroy Tsipras’ political reason for being. He got into the game rejecting the status quo that Greece was stuck in. By accepting it, he would be contradicting everything he stands for.

Since then, the European leaders have been focussing their efforts on how to limit the damage to their economies as they are facing one of the biggest crises in the history of the euro. US President Obama reportedly called German Chancellor Angela Merkel after Greece announced its decision, and the two agreed to take all the necessary steps to resolve this crisis.

The European Central Bank (ECB) announced that it will no longer be providing Greece’s bank with emergency support. Greece is heading for default as early as June 30, and may ultimately have to leave the euro.

The curbs on banking imposed by Greece on June 28 are known as capital controls, which are used only at times of extreme stress in a banking system.

How bad would ‘Grexit’ be?

‘Grexit’ – Greek exit from Euro.

Paul Krugman, the world famous economist, recently said the creation of the euro was the greatest mistake ever. However, some of the best economists in the world, especially in the Euro zone will contend that Krugman is out of his mind. However, take a closer look at the Greek crisis and cracks begin to emerge, insinuating that Krugman may be bang-on on the money. The euro may not be the ‘biggest’ mistake, however, it does have its shortcomings.

To understand this fully one has to realise that most – not all, but most – of what is being said about the irresponsibility of the Greek government, is false. Yes the government spent beyond its means in the early 2000s. But since then it has repeatedly slashed spending and raised taxes. It cut the exorbitant pensions it was doling out and lost almost 25 per cent of the government work force. The austerity measures introduced sum up to be more than enough to eliminate the original deficit and turn it into a large surplus.

Why did this not work? Because the economy collapsed, largely due to the very austerity measures employed to avoid that.

This collapse had a lot to do with the euro. In other countries facing similar problems, the answer would be large currency devaluations that would make their exports more competitive. Once devaluation is put in place, the austerity measures implemented begin to take effect.

This worked for Canada in 1990, but for Greece this was not possible as it does not have its own currency.

Thus, maybe the best thing for Greece to do, is leave the euro. However, a Grexit could lead to major repercussions, the kind that have not been seen since the 2008 global market collapse after the Lehman Brothers case.

Global financial chaos

The Lehman collapse caught everyone by surprise, leading to the meltdown of global markets. Investors are now concerned that a similar situation is imminent because of Greece.

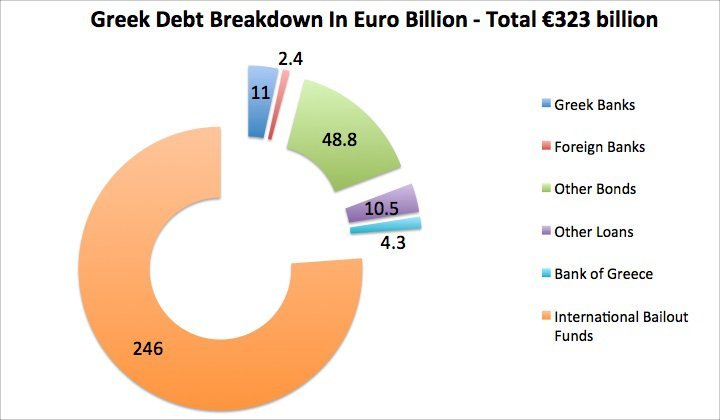

If Greece leaves the euro zone, it could lead to a collapse of the latter’s financial system given the huge amount of debt owed to members of the European Union by Greece. It could also lead to a domino effect in other economies, particularly that of Spain and Italy, which are considerably larger than Greece and could have a bigger impact on the GDP of the zone.

A collapse of the euro zone will have major effects on the global economy, as a massive percentage of global exports are consumed by countries in this zone.

The repercussions of the Greek crisis are already being felt in parts of the world. The Indian stock exchange, Sensex, opened on a negative note on June 29. It exercised caution throughout the day as investors were worried about the Greek crisis. The BSE Sensex fell 166.69 points to close at 27,645.15. NSE Nifty shed 62.70 points to end at 8,318.40.

At this point one can only hope that the Tsipras government in Greece knows what it is doing. It is all very well to take a stand against bullying by the Euro zone members, but it should not affect the financial stability of the entire region.