In one of the biggest mergers of the corporate history, world’s top two brewers Anheuser-Busch InBev and SABMiller have signed up a $100 billion deal almost after a month-long courtship.

The official announcement came on Tuesday, October13, that would merge AB InBev’s Budweiser, Stella Artois and Corona brands with SABMiller’s Peroni, Grolsch and Pilsner Urquell, brewing almost a third of the world’s beer, dwarfing other major producers like Heineken and Carlsberg.

If it goes through, the deal would rank as the fourth-biggest takeover in history and the largest deal for a UK company. It also breaks all records in the consumer sector and comes only days after news that Dell Inc and EMC agreed the biggest ever deal in the technology sector. It could also surpass all consumer products companies except Procter & Gamble and Nestle in size.

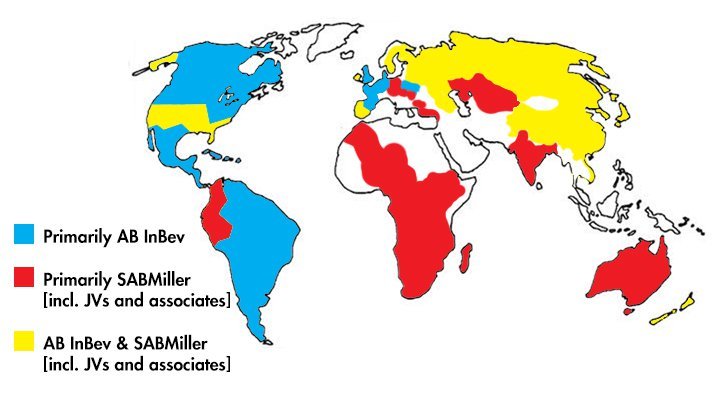

For AB InBev, the SABMiller deal will give it more breweries in Latin America and Asia and an entrance to Africa at a time when some of its home markets such as the United States are weakening as drinkers shun mainstream lagers in favour of craft brews and cocktails.

Africa is expected to see a sharp rise in the legal drinking age population in the next few years and a fast-growing middle class which prefers branded lagers and ales to the illicit brews which have long been a feature of markets there.

The agreement took place just two days before a deadline that would have forced AB InBev to make a formal bid or walk away for six months.

At the end of the day though, it’s a good news for beer lovers all across the world.