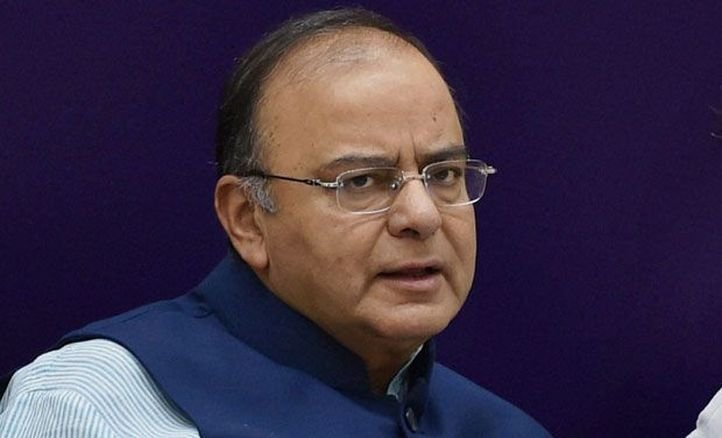

As much as Rs 65,250 crore of blackmoney was declared during the four-month compliance window — the Income Declaration Scheme — that ended on September 30, Finance Minister Arun Jaitley said on Saturday.

Jaitley said 64,275 declarations were made in the four- month window and this figure could go up once all the declarations filed online and manually are compiled.

The money declared totals Rs 65,250 crore, of which 45 per cent would accrue to the government as tax and penalty.

The government had provided illegal income and asset holders a one-time opportunity to come clean by declaring their blackmoney under the four-month window and pay 45 per cent tax and penalty.

Reiterating that the one-time window was not an amnesty scheme like the 1997 one, Jaitley said the tax collected in the 1997 Voluntary Disclosure of Income Scheme (VDIS) was Rs 9,760 crore with an average declaration of Rs 7 lakh.

The tax collected from the Income Declaration Scheme (IDS) 2016 will go into the Consolidated Fund of India and will be used for larger welfare of people, he added.