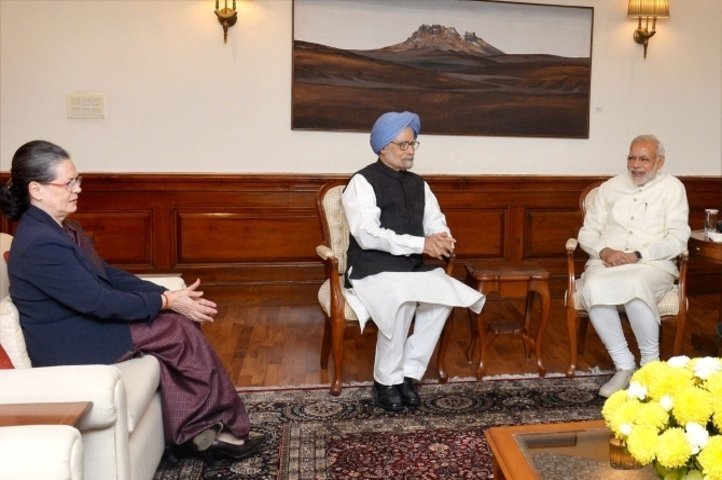

The Goods and Services Tax (GST) has been making news across the country for several weeks, as it even led the Prime Minister Narendra Modi to invite Manmohan Singh and Sonia Gandhi to his chai pe charcha in efforts to get the bill approved in the winter session.

The new value added tax promises to break the clutter of different indirect central and state taxes to create a simpler tax regime which can be easily enforced.

Here’s all you need to know about the tax that is in the spotlight:

1. The GST is being touted a the most revolutionary tax reform in India since independence, as Arun Jaitley said that it will lead to the financial integration of India.

2. GST was first brought up in 2009 by the UPA regime, but despite a discussion they failed to get it passed. In 2014, the NDA regime brought it back with few changes.

3. GST will break the complicated structure of separate central and state taxes which often overlap with each other, to create a uniform taxation system which will be applicable across the country.

4. Taxes will be implemented more effectively since a network of indirect taxes like excise duty, service tax, central sales tax, value added tax (VAT) and octroi will be replaced by one single tax.

5. The state will still have a say in taxation, as the number of taxes will be reduced to three with Central GST, State GST and Integrated GST for inter-state dealings.

6. Finance Minister Arun Jaitley has claimed that once GST is implemented, India’s GDP will experience a growth of about 2%.

7. MNCs will find it easier to do business in India since GST will become a single tax which the companies will pay as opposed to several taxes on different levels.

8. There will be a GST council which will include union as well as state ministers dealing with finances, while a dispute redressal committee will ensure swift solution to problems among ministers.

9. GST needs two-third majority of both houses and approval of 50 percent of state assemblies. Although the bill was cleared in Lok Sabha, it is stuck in the Rajya Sabha where NDA does not have a majority.

10. One of the problems of GST is that state administrations fear a loss due to it, but that will be taken care of with compensation packages against revenue losses to states for three years.

11. Another concern is the inclusion of petroleum products in the GST as for now states will continue to collect VAT and sales tax for the same.

12. The key reason for the bill being stalled is that the Congress has demanded reforms and has alleged that their concerns over the bill are being simply ignored.

13. Although the tax will bring down tax rates, the collection of taxes will increase thanks to the larger area covered by GST.

14. An IT platform for implementation of GST is also in the pipeline.

As the centre is trying to tackle the opposition’s demands and negotiating its way through the concerns raised by the Congress, they are hopeful that the crucial reform will finally come into effect by April 2016.

Top picks for you