An Indian tribunal on Monday has temporarily halted a Rs 500 Crore settlement due to be paid by spirits giant Diageo Plc to liquor baron Vijay Mallya, after he resigned as chairman of Diageo unit United Spirits.

The court ruled in favour of a group of creditor banks, owed money by Mallya’s now-defunct Kingfisher Airlines, and who had argued they had the ‘first right’ to that money.

Earlier, the Enforcement Directorate had registered a money laundering case against him and others in connection with the alleged default of over Rs 900 crore loan from IDBI bank.

Official sources said the agency recently filed charges under the Prevention of Money Laundering Act (PMLA) based on an FIR registered last year by CBI in the same case. They said while the ED’s zonal office here has registered the case, sleuths are also looking at the overall financial structure of the now defunct Kingfisher airlines and a separate probe under foreign exchange violation charges could also be initiated.

“Mallya and others will soon be questioned. The agency has collected relevant documents from concerned authorities and the bank in question,” they said. The ED has pressed charges under various sections of the PMLA against Mallya and others named in the CBI complaint.

The CBI had booked Mallya, director of Kingfisher Airlines, the company, A Raghunathan, Chief Financial Officer of the airlines, and unknown officials of IDBI Bank in its FIR alleging that the loan was sanctioned in violation of norms regarding credit limits. The CBI action came as part of its wide probe into criminal aspects of loans declared to be non-performing assets by public sector banks.

The ED is looking into the “proceeds of crime” that would have been generated using the slush funds of the alleged loan fraud, they said. While a DRT order is expected in this case today, ex-Kingfisher airlines employees have also gone public against Mallya and the company alleging they have been cheated of their remuneration and service benefits.

Mallya had yesterday said he is making efforts to reach a ‘one-time settlement’ with banks through additional payments to the lenders, even as he denied “personally” being a “borrower or judgement defaulter” and alleged that “disinformation campaign” was being played to make him a “poster boy” of all bad loans.

The debt-laden airlines had stopped operations in October 2012.

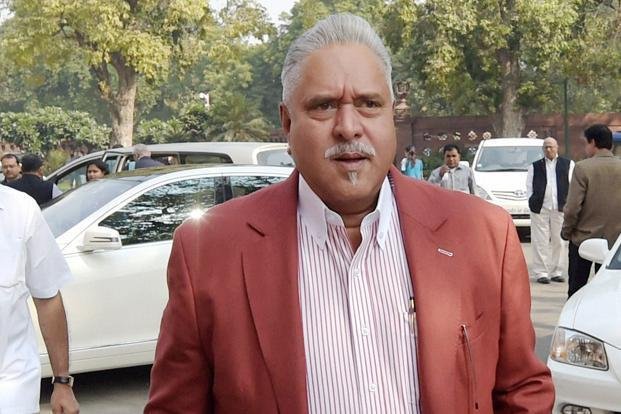

(Feature Image Source: AFP)