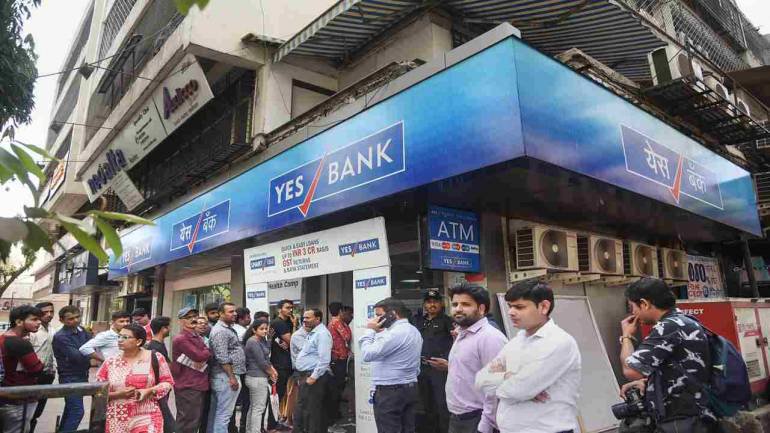

After RBI imposed a moratorium on the private bank, panicked customers lined up in long queues to withdraw money.

However, Yes Bank took to Twitter to announce that customers will be able to make withdrawals (up to ₹50,000) using their Yes Bank Debit Card both, at Yes Bank and other bank ATMs.

You can now make withdrawals using your YES BANK Debit Card both at YES BANK and other bank ATMs. Thanks for your patience. @RBI @FinMinIndia

— YES BANK (@YESBANK) March 7, 2020

So, if you are an account holder at Yes Bank, and are confused about the whole situation, here are a few things you must be aware of regarding the restrictions imposed by RBI and how they will impact you as a customer.

1. What restrictions have been put in place by RBI for Yes Bank customers?

2. Will RBI restrictions impact your loan EMI, SIP and insurance payments?

3. What will happen if you hold a salary account in Yes Bank?

– You may have to get in touch with your employer to figure out an alternative way to get your money as you won’t be able to withdraw more than ₹50,000.

4. What will happen if your account is linked with mutual fund investments?

– If your savings account is linked with your mutual funds you may have to change it immediately as several mutual funds have stopped accepting redemption requests from their schemes into Yes Bank accounts to protect investors.

5. Should you be worried as a Yes Bank account holder?

– RBI has said that the interests of the account holders will be protected and there is no need to worry.

In 2003 and 2010, a similar situation occurred when RBI ordered amalgamation of Global Trust Bank with Oriental Bank of Commerce and when IDBI Bank took over United Western Bank respectively.

For more information, please contact Yes Bank customer care.