There has been an endless debate around government’s 12% GST on sanitary napkins. People all over the country have expressed their anger over taxing and that too so highly for a product that is essential for women. Is it fair to put an essential commodity under such high tax slab?

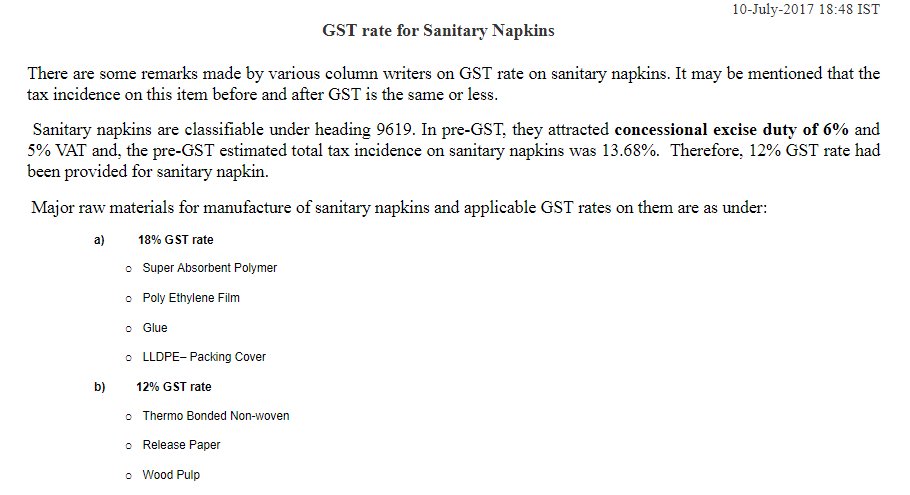

After a prolonged silence, the Ministry of Finance recently put out a press release on July 10 to clear the air around this complicated tax structure.

What does the press release say?

The press release reads, “There are some remarks made by various column writers on GST rate on sanitary napkins. It may be mentioned that the tax incidence on this item before and after GST is the same or less”

It further says that pre-GST, the sanitary napkins attracted a ‘concessional excise duty of 6% and 5% VAT’ which amounted to a 13.68% overall tax. This was actually more than the new 12% GST.

Also, as the raw materials used to make a sanitary napkin attract between 12% to 18 % tax, demanding less or no tax will be unfair to local manufacturers. This will cause ‘ an inversion in the GST structure,’ claims the release.

If the GST rate on sanitary napkins was reduced to 5%, it will further accentuate the tax inversion and result in even higher accumulated input tax credit (ITC), with correspondingly higher financial costs on account of fund blockage and associated administrative cost of refunds, putting domestic manufacturers at even greater disadvantage vis-a-vis imports.

Basically, it is not profitable to tax the final product at a lower tax rate when the raw materials used are taxed at a higher rate.

However, as logical as this argument may sound, there are few points that counter their argument.

Why does the government’s claim falls flat?

An Economic Times report claims that previously the tax rate on the product was about 6% across India while the VAT only applied to a handful of states. This means that the tax rate for few states has actually gone up from 6% to 12%, making the napkin expensive post GST.

The report also states that the raw materials namely super absorbent polymer, glue and wood pulp that attract GST between 12 % to 18% only accounts for 20% of the total cost.

80% of the total cost is due to the usage of cotton. Cotton is the main raw material that only attracts a 5% GST, thus government’s argument of ‘an inversion in the GST structure’ becomes null and void, states the report.

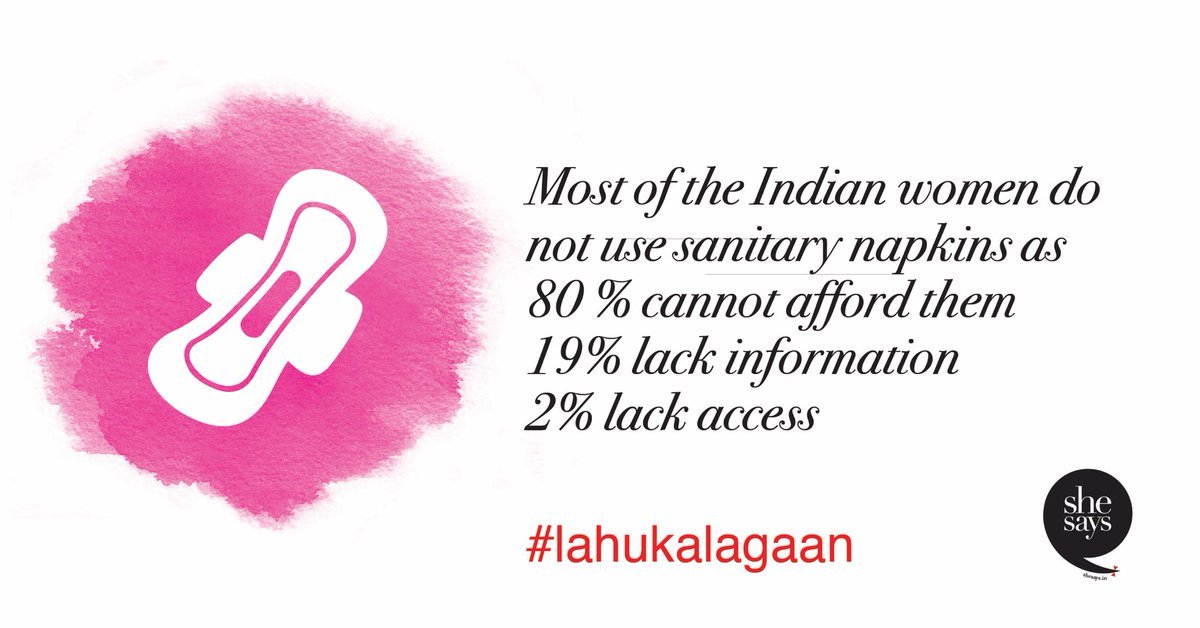

Echoing similar concerns, Trisha Shetty, founder of the NGO She Say that is currently running the popular #LahuKaLagaan campaign told ScoopWhoop News that the government’s argument makes no sense as the core material, cotton, is subjected to a very low GST.

She, however, confirmed that as far as Maharashtra is concerned, the tax rate has come down as previously the VAT amounted to 6% but that is not the case for other states which attracted a much lower tax rate.

She’s been urging the government to make sanitary napkins an essential commodity and waive off any kind of tax.

‘Tax reduction will not benefit much’

To this, the Cabinet Minister of Finance, Maharashtra, Sudhir Mungantiwar said that even if the government exempted sanitary napkins from the ambit of tax or even reduced it, the multinational companies won’t let the benefit trickle down to the consumers.

Mungantiwar added, “A single pad costs Rs 11, even if tax is reduced or removed, the pad will continue to cost somewhere between Rs 8-9.5, making not much of a difference”

Questioning the claims, Trisha says, “Where is this assumption coming from? Why will MNCs not let consumers benefit? They don’t run the country. Make sanitary napkins an essential commodity first, don’t worry about the MNCs,” she said.

On why Government is not considering sanitary napkins an essential commodity, Mungantiwar told ScoopWhoop News that the process is long and uneasy and if there is a provision, the government will look into it.

Exemptions that don’t matter much

Defending the government and their efforts for women, Mungantiwar said that they have exempted small cooperatives and SHG with a turnover of Rs 20 lakh and less from GST.

“Pads produced by local SHG are available for a mere Rs 2-2.5 per piece which is cheaper than their international counterparts,” he said.

By encouraging women to use cheaper sanitary napkins, not only will it be pocket-friendly to them, it will also help boost the SHGs, added Mungantiwar.

Significantly, this exemption is not special to sanitary napkins and applies to all kinds of products produced by companies with a lower annual turnover.

A Maharashtra based social enterprise Aakar innovations that manufacturers cheap and bio degradable sanitary pads told ScoopWhoop News that companies like theirs, unfortunately, cannot reap the benefit of this exemption.

Priyankit Tanwar, Manager Sales, said that as they also produce and sell machines that manufactures sanitary napkins, their turnover amounts to a little over 20 lakh annually. Thus, they are being taxed.

“We work with several SHG and sell cheap sanitary napkins. Unlike brands like Whisper which has a 51% market share, we cater to rural consumers. Our pack of 8 pads is sold for Rs 28. Post GST it will cost more but we have decided to not change the price and bear the losses ourselves,” he said.

Feature image design credit : Saurabh Rathore/ScoopWhoop