Neglecting a budget, dodging bills, and treating credit cards as bottomless pits are all surefire paths to financial chaos. Falling for get-rich-quick schemes and ignoring the need for an emergency fund leave you vulnerable to sudden financial storms. Disregarding your credit score and skipping the fine print on financial agreements can lead to costly consequences. Trying to keep up with others’ lavish lifestyles only plunges you deeper into debt. Neglecting to invest in yourself and delaying retirement savings are missed opportunities that compound over time. Avoiding these missteps is crucial to securing a stable financial future and preventing a life of ruin.

Hold on to your wallets, folks, because here is the rundown of 10 Financial Faux Pas that’ll have your bank account weeping-

1. Credit Card Catastrophe

Swiping without sweating? Watch out! That plastic isn’t a magic lamp, and there’s no genie to bail you out. Before you know it, you’re in a debt desert, with mirages of money, and no oasis in sight.

2. Savings Shavings

Savings account? More like a mythical creature for some. If you’re treating savings like a unicorn, don’t be surprised when your bank balance doesn’t have that magical glow. Start saving, or your finances might just become a legend… and not in a good way.

Also Read: Salary Negotiation Tips You Should Follow Cos There’s No Shame In Asking For Money You Deserve

3. Astrological Investments

My horoscope said I’m lucky today, so I bought stocks!” If that’s your strategy, you might as well make financial decisions based on your fortune cookie. Align your investments with goals, not stars, unless you want a cosmic crash landing.

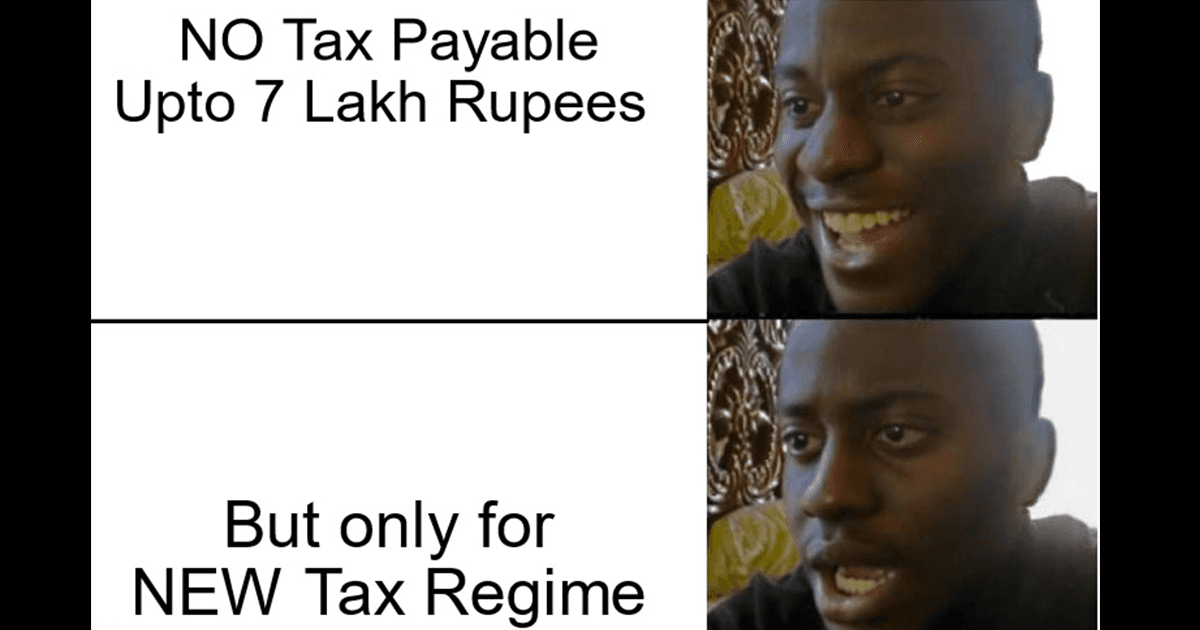

4. Yawn-Worthy Yields

Insurance, taxes, retirement plans—sounds like a snooze fest, right? Wrong! Ignoring these can lead to a nightmare where your future self is haunted by the ghosts of financial neglect. Wake up and smell the security!

5. Daily Deluxe Dilemma

Treating yourself daily? That’s a one-way ticket to Brokeville. Your wallet isn’t an all-you-can-eat buffet. Indulge wisely, or your bank account will be the one needing a treat—a cash infusion.

6. Crypto ‘Craze-y’

Jumping on every crypto trend? That’s like surfing on quicksand. Sure, it’s thrilling until you sink. Diversify your investments, or your digital wallet might just go on a permanent vacation.

Also Read: People Share The Biggest Financial Mistakes They Made In Their 20s & It’s The Wake Up Call We Need

7. Budget Blindness

Budgeting by checking your balance before a splurge? That’s like driving with a blindfold. Map out your expenses, or you’ll crash into Debt Mountain. And spoiler alert: the view from the top isn’t pretty.

8. Loan-a-Lot

Generosity is great, but if you’re handing out loans like candy on Halloween, you’ll soon find your finances in a horror story. Keep your generosity in check, or you might be the one needing a financial lifeline.

9. Label Lunacy

Obsessed with brands? That logo won’t look so luxe when your account hits zero. Remember, a brand won’t pay your bills, but smart spending will keep you in style—and solvent.

10. Sale Fails

But it’s on sale!” is the siren song of unnecessary spending. Resist the call, or you’ll sail straight into a sea of stuff you didn’t need. Save 100% by keeping your wallet closed.

Also Read: People Share The Worst Financial Advice They Got. Don’t Make These Mistakes

And there you have it, the top ten financial facepalms to avoid. Stay savvy, and your bank account will thank you!