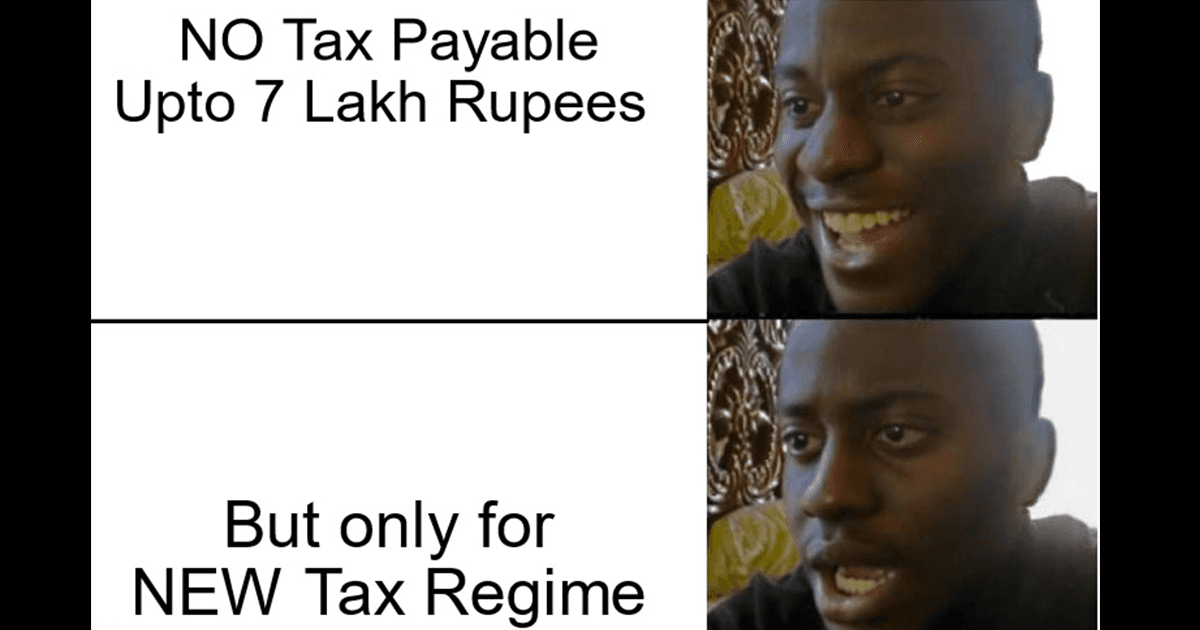

Let’s talk about something that we all struggle with – saving up. We know saving up is important but when we look at how expensive everything has gotten around us, it feels like a Herculean task. Increased rent prices, food prices, transport etc, everything just makes saving up look impossible.

But if you look closely, it isn’t that difficult. At least that’s what some people believe. We found a Reddit thread on the India subreddit where people who earn ₹40-60K share their tips on how to save up a small fraction of their salary. Their answers are helpful AF.

1. “Do a SIP/RD that gets auto-debited (even if it’s ₹5000), move to cheaper/shared accommodation, find your biggest expense category and try to reduce that, and use public transport for commuting.” – shayanrc

2. “Important thing is to have the habit of saving up even if it’s a small amount so that you’re cognizant of your spending patterns.” – reddituser_scrolls

3. “Keep a certain percentage of your salary away and forget about it. Like, it never existed and think that the deducted amount is your actual salary. That’s what I do. You will need to have a strong mind for this.” – Happy_Resist5428

4. “You can’t save more than 40% living in any Indian metro unless you have a home bought by your previous generation in the city. The best way to cope is to spend all your time looking to increase the pay. Build enough skills so that you can gain financial independence in a decade or two, move back, and settle in a Tier 2 city. Life’s easier that way.” – IndividualLow6292

5. “Make a list of fixed expenses – your rent, food and other expenses. Send a percentage of your salary to a different savings account the day your salary is credited. You would have less amount to spend from day 1. This would work provided you are doing some needless expense on stuff that you do not need.” – Lucifer_96

6. “You need a package of around 20LPA if you wanna save money in a metro city comfortably.” – n0treallynew

:max_bytes(150000):strip_icc()/mumbai-skyline-from-malabar-hill-mumbai-maharashtra-india-asia-547416209-58b9cb8b5f9b58af5ca70b8e.jpg)

Also Read: 10 Things You Will Relate To If You Just Can’t Save

7. “One of the safest options is to create a PPF account (it pays you higher interest than FD/RD). Put at least ₹9000 every month into your PPF account (auto-debited every month). If you complete your full tenure and extend it for 10 more years, you can make up to ₹1 Crore.” – Srihari_stan

8. “I think the solution to this is saving small amounts and investing. It won’t be an instant rise in income: but in the long term as your salary increases and you don’t stop investing, it will be beneficial. Having multiple streams of income is the only way to have some good amount of money.” – X_HypeRDragoN

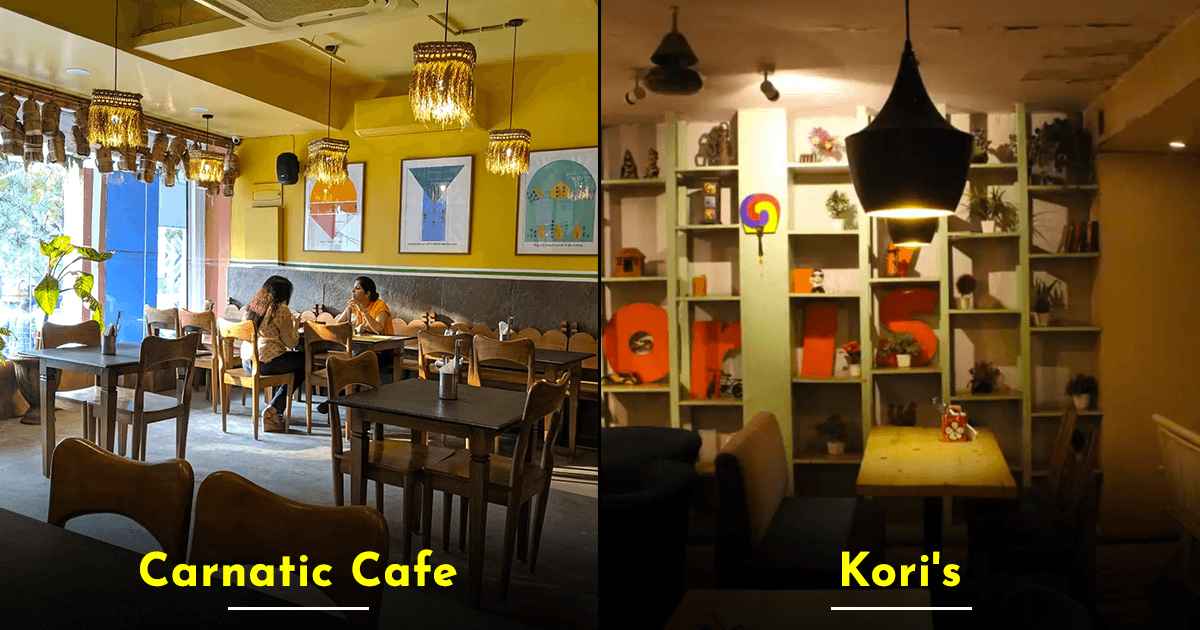

9. “If you are in Bangalore, you can easily save ₹20-25k even ₹30k if you can live frugal life. But yes, more than 50% saving with this salary will be tough though.” – Sanchit_Lsc

10. “Start making emergency funds in a different account than your salary account, which you don’t touch unless something really really important comes up.” – anubhav316

11. “Use coupons/deals shamelessly. We all have one friend who is able to save a lot by constantly looking for offers. Be him or be friends with him/her.” – anubhav316

12. “You don’t make money by savings. You make money by earning/investing more.” – Minimum-Ad9225

Bookmark this page because we all know we could do with some budgeting and saving hacks.

Check Out- Moving Out Soon? 9 Ways To Manage Money While Living Away From Home